tax avoidance vs tax evasion examples

Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object. If youre going to pay a household employee like a nanny or a cleaner that money needs to be.

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Tax avoidance uses the tax code to.

. Payment of tax is avoided though by complying with the provisions of law but defeating the intention of law. For example if someone transfers assets to prevent the IRS from determining their. People guilty of tax evasion can face up to.

Some common examples of tax evasion include. Wednesday October 12 2022 -Tax Evasion is a crime. A few examples of tax evasion are an individual a firm or a company.

Moreover one of the common examples of tax avoidance to minimize a taxable income is. Payment of tax is avoided through. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business.

Paying household employees under the table. Common examples of tax evasion include. If youre going to pay a household employee like a nanny or a cleaner that.

The government offers various exemptions like retirement plans mutual funds municipal bonds and tax credits. Hence check the details below to get to know about tax evasion vs tax avoidance. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income.

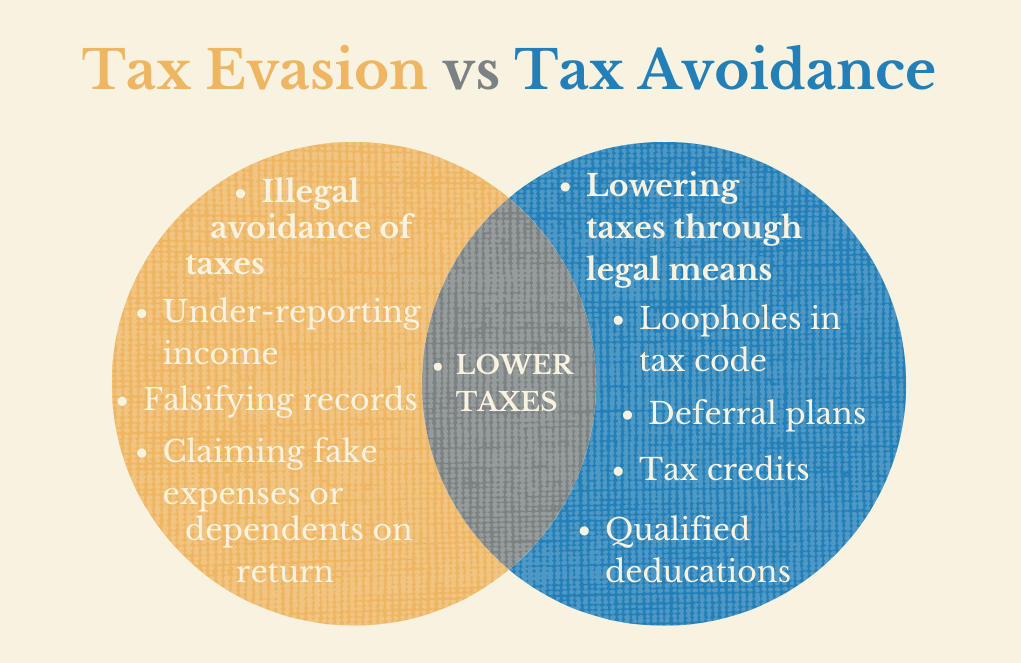

There is a clear-cut difference between tax avoidance and tax evasion. Tax Evasion vs. Tax evasionThe failure to pay or a deliberate underpayment of.

Tax avoidance is different from tax evasion which involves illegal ways of getting rid of the tax responsibilities or conducting tax frauds Tax Fraud Tax fraud is the deliberate use of wrong. Ad Register and Subscribe Now to work on your IRS The Difference Between Tax Avoidance Form. Tax evasion is often confused with tax avoidance.

Examples of tax evasion include such actions as when a. Tax evasion however is illegal and Chapter XXII of the Income Tax Act 1961 is clear about penalties. Perilaku tax avoidance dapat mencerminkan adanya kepentingan pribadi manajer dengan cara melakukan manipulasi laba yang akan mengakibatkan adanya informasi yang tidak benar.

It is a legal strategy that. Tax avoidance is the use of tax-saving. Tax Avoidance is your duty as an American in my opinion.

Tax evasion is a federal offense which means if you are found guilty of it in one state you may face sanctions and restrictions all over the country. In tax avoidance you structure your affairs to. One is legally acceptable and the other is an offense.

PdfFiller allows users to edit sign fill and share all type of documents online. The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax evasion occurs when the taxpayer either evades assessment or evades payment.

Paying household employees under the table. Tax Evasion Methods Examples False Reporting Tax Underpayment. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes.

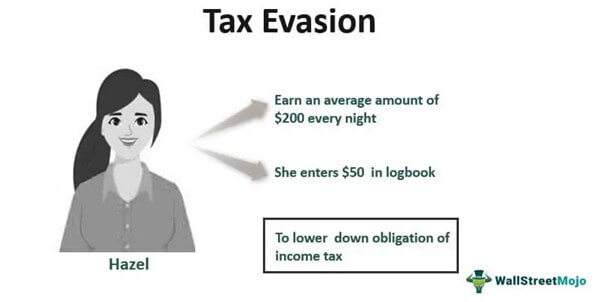

It is when someone reports less income than their actual earnings It comes under an attempt of assessment. Not reporting or under-reporting income to the tax authorities Keeping business off the books by dealing in cash or other devices with no receipts. Some common examples of tax evasion include.

However tax evasion is illegal whereas tax avoidance is legal.

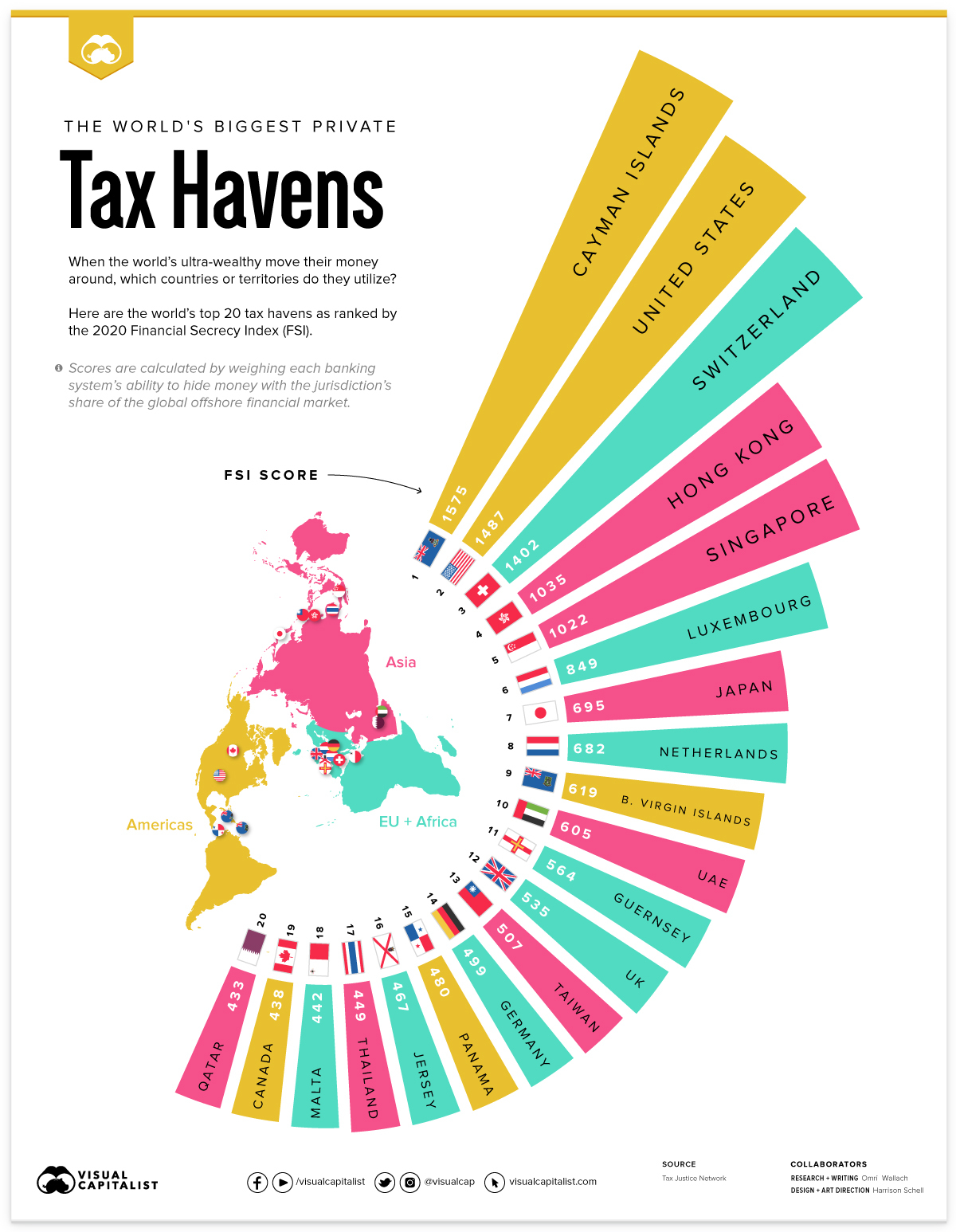

Which Countries Are Worst Affected By Tax Avoidance World Economic Forum

Opinion Make Tax Dodging Companies Pay For Biden S Infrastructure Plan The New York Times

Tax Evasion Vs Tax Avoidance Dsj Cpa

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Topics Border Adjustments And Tax Avoidance Aaf

Mapped The World S Biggest Private Tax Havens In 2021

Tax Avoidance Vs Tax Evasion Differences You Need To Know

Tax Avoidance Vs Tax Evasion What Are The Penalties

Tax Evasion Vs Tax Avoidance Difference Examples Supermoney

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Morale And International Tax Evasion Sciencedirect

Tax Evasion Meaning Types Examples Penalties

Tax Avoidance Vs Tax Evasion Fiscal Vocabulary Made Easy News European Parliament

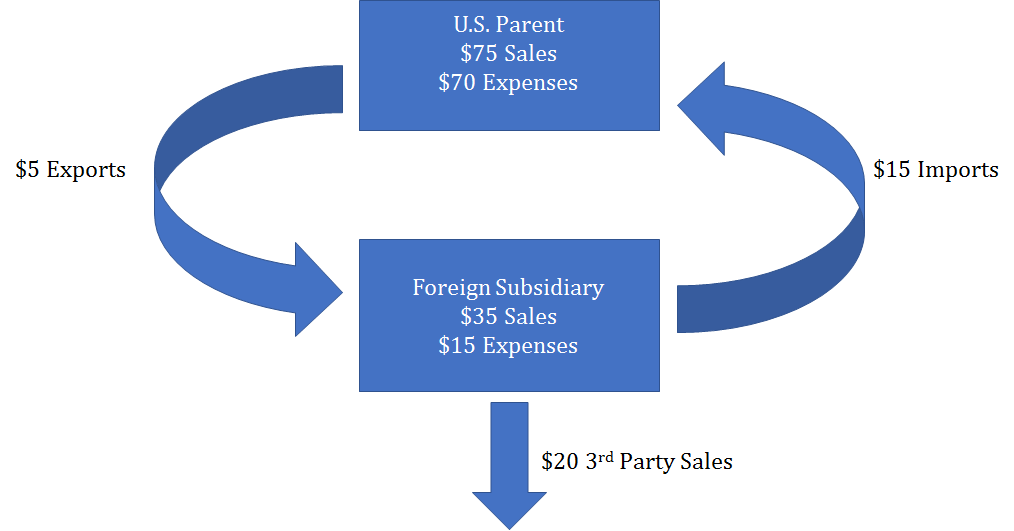

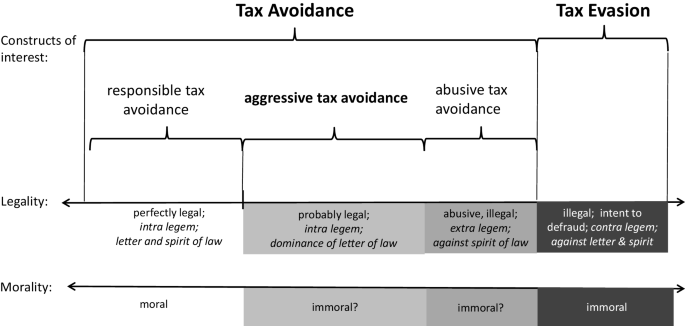

Aggressive Tax Avoidance By Managers Of Multinational Companies As A Violation Of Their Moral Duty To Obey The Law A Kantian Rationale Springerlink

Tax Avoidance And Tax Evasion What Are The Differences

What Is The Average Jail Time For Tax Evasion Milikowsky Tax Law Schedule Consultation

Differences Between Tax Evasion Tax Avoidance And Tax Planning